June 21, 2019

By Katherine Monahan, Dave Sawyer and Jotham Peters

The costs of climate change and climate change action receive a lot of attention, but what often gets overlooked is the sizeable economic opportunity that awaits those who solve it. Yet our recent analysis of the clean growth investment opportunity finds that Canadian demand for low-carbon technologies will double through 2030 compared to today’s levels. Investment in low-carbon technologies will climb from an historical annual average of $11 billion in the pre-2020 era, to an average of $22 billion annually through 2030, pointing to a considerable financial opportunity.

This opportunity reflects what most people would agree with, that good climate change plans lower greenhouse gas emissions while minimising economic and distributional impacts. Successful plans help change consumption and investment patterns away from carbon-intensive activities towards lower-carbon technologies and practices. For example, spurring the decision to purchase an energy-efficient boiler for your office building or home.

The adoption of these clean technologies underpins clean growth. Yet as intuitive as it might be that Canada will need to use more clean technologies to lower emissions, the questions of, How much more, and where? remain largely unanswered.

In our new report Growing Clean -- Investment Flows in Low-Carbon Technology to 2030, economy-wide modelling is used to help answer these timely questions. This type of analysis is useful to investors and governments who must make good investment decisions that finance our low-carbon transition. This report also explains the importance of explicitly mapping-out investment patterns under various climate policy scenarios.

The size of the opportunity – what can we expect from a low-carbon pathway?

Our analysis uses economic and energy modelling to explore how Canadian demand and investment for clean technologies will change from today’s levels as Canada moves towards its Paris commitment (i.e. to reduce greenhouse gas emissions by 30% below 2005 levels by 2030).

As mentioned, both demand and investment in clean technology are expected to double in the next decade. Currently, the simulations suggest that businesses that buy equipment such as machinery or vehicles, spend only about 2% of their budget on low-carbon technologies. The analysis shows this number rising to 4% of their budget post 2020. For households, incremental spending on items such as low-carbon vehicles, appliances, and home heating systems would rise from 5% of their investment budget today, to 19% on a low-carbon pathway.

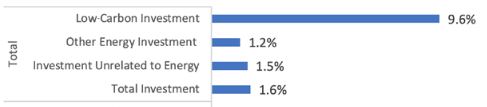

The rate at which these technologies are adopted is fast and furious. Overall Canadian investment grows at 1.6% per year through 2030, but investment into low-carbon technologies increases at almost 10% annually (Figure 1).

Figure 1: Average Annual Growth Rate of Investment (2020-2030)

What does this mean for Canada’s financial sector?

“Within the Pan-Canadian framework [for climate change and clean growth] are investment flows, but these are implicit and haven’t been mapped out. Let’s map these out… What is the investment that is actually needed?” - Tiff Macklem, Expert Panel final report launch, June 14, 2019.

The increasing costs associated with the impacts of climate change are often poorly reflected in financial statements and risk management frameworks across Canada. But likewise, these investment opportunities, implicit in our pathway to the 2030 target, are not properly captured.

These unchartered opportunities were highlighted by the Expert Panel on Sustainable Finance last Friday (June 14th, 2019), in its final report, Mobilizing Finance for Sustainable Growth, which lays out a package of recommendations aimed at “connecting the dots” between Canada’s “climate objectives, economic ambitions, and investment imperatives”.

With better expectations around the magnitude of the domestic market opportunity for low-carbon technologies, the financial sector will be better equipped, with an outcome that should see capital flow towards low-carbon areas (i.e., what’s needed to address climate change).

Low-carbon technologies for every sector of the economy

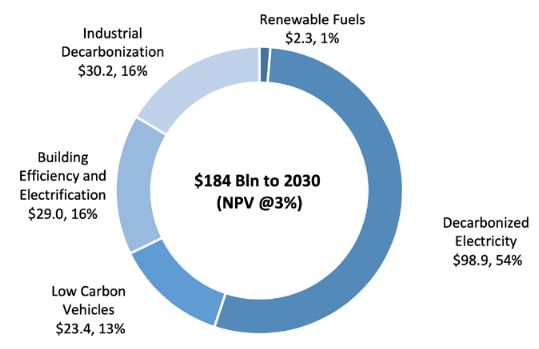

The analysis also pinpoints sectoral-level investment trends through 2030. For example, investment into non-emitting electricity technologies, such as solar and wind, will increase by 70% to $12 billion annually. As another example, and more pertinent to households, there will be a six-fold increase in investment for low-carbon vehicles, with Canadians related spending up to $2.8 billion annually post-2020 (Figure 2).

The specific technologies identified in the analysis are all readily available in Canada, and in many cases, investments into these areas pay off in the longer term through reduced energy costs. For example, this could look like reduced fuel costs from electric vehicles, or reduced heating costs from home retrofits. What’s really needed now is to increase adoption rates, and sustainable finance certainly offers ways to do that.

We also need to keep in mind that compared to the massive flow of investment transactions economy wide, the incremental costs associated with low-carbon technology investment are small. It does not cost much more to ensure that new buildings, vehicles and machinery are more compatible with GHG mitigation goals, especially when the right mix of energy efficiency and low-carbon technologies are optimised.

Figure 2: Cumulative Investment – Sector by Sector to 2030

Let’s hear it for forward-looking, scenario-based assessments for low-carbon investment

There is now a price on carbon across most of Canada, and every province has a plan to reduce emissions through various polices and measures. Implicit in these plans is the aim to shift consumer preferences and spur broader investment decisions towards lower carbon alternative technologies.

However, the Expert Panel’s consultations revealed a general lack of appreciation for the magnitude and pace of the low-carbon investment required to realize these plans. Hence, it is clear that more forward-looking scenario-based analysis is needed, such as the one we released today in Growing Clean.

Our deep look at clean growth investment reveals that the size and pace of investment opportunities are significant within Canada’s current climate policy pathway. It also highlights that in order to meet climate change mitigation commitments, Canada will need to continue to reorient public and private investment towards the low-carbon solutions identified in the analysis, but this reallocation is manageable and achievable. The clean growth opportunity presents itself and we should not let it pass us by.